We are currently researching this question and look forward to having a definitive answer soon.

Click on a question below to view the answer. Limit the results by entering a search term.

Amazon Business

Campus customers should ALWAYS go to the strategic master agreements on Ariba eProcurement first to meet their purchasing needs. If the product they are looking for is not available from any of our existing eProcurement Suppliers, Amazon is an available resource to locate those hard-to-find or specialized items.

You do so by emailing AmazonBusiness@uw.edu, and we will have Amazon send you a request to confirm your email address and start using your account. Make sure to include the following set of information below in your email:

a. Name of your group

b. Name and email address of the person who will be an Administrator in your Group; you can have more than one Administrator for a group.

c. Names and email addresses of other users to be added to your group and their roles (Requisitioner or Administrator or both)

We will respond with an invitation within 24‐48 hours unless he has additional questions. Any of the above roles can be changed later if needed.

Yes, as with the Prime Two‐Day shipping benefit, it is only limited to eligible items displaying “Free Two‐Day Shipping” next to their price. Items must be sold or fulfilled by Amazon to be eligible for Free Two‐Day Shipping by Amazon. Gift cards and some oversized and / or heavy items are not eligible. Learn more about eligibility restrictions at: http://www.amazon.com/gp/help/customer/display.html/ref=b2b_faq_ot_pf?ie...

Amazon Business provides an efficient and easy shopping experience, however, in the Amazon Business Accounts Terms and Conditions (June 22, 2018 edition), they stated that they are currently not able to accept federal flow downs terms and conditions. Based on that, we are advising our campus customers to keep the purchases with Amazon Business Prime under the current Procard single transaction limit of $3,500.

Follow the steps in response to Question 2 but also inform us at AmazonBusiness@uw.edu that you have an existing Prime account and provide the log in email address for that account. When we invite you using that same email address, you have the option of importing all your existing ordering history over to your Business account. If you use your personal email address for your Prime membership, you would need to use a UW email address to set up the Business Account and should use your personal Prime account for personal shopping only.

If you have recently purchased a Prime Member for the sole purpose of your departmental purchases (not personal) and have barely started using the free two‐day shipping benefit, then Amazon will provide a prorated refund based on the estimated amount of shipping benefits already used with that Prime account. If you are near the expiration of your Prime membership, we recommend that you let the Prime membership expire and instead of renewing, set up an Amazon Business account. Anyone who is seeking a refund for Prime will need to contact Business Customer Support. Refunds are based on how much of the Prime shipping benefits that have been used to date.

Amazon Business Customer Support: (888) 281‐3847

UW has established a Master Account with Amazon Business and that would be the top tier in our account structure. We will then set up separate groups under the UW Master Account and each Group can be a separate school, department or business unit. Within each group, there will be a Group account administrator who has the ability to create sub‐groups within the group, invite additional users, and set each user’s approval limits. Again, this is an interim measure for the time being. Once Amazon becomes a punch‐out catalog supplier in eProcurement, it will default back to the existing Ariba ordering approval workflow for your department.

Yes, and furthermore, if you have already established that as part of your Prime account profile, all that detail will simply transition over to your new Amazon Business account.

In order to successfully integrate Amazon Business into Ariba, we need to convert all existing individual Amazon Business Accounts under the single UW master account. All the account details including shopping lists will transfer over under your group account profile under the UW master account.

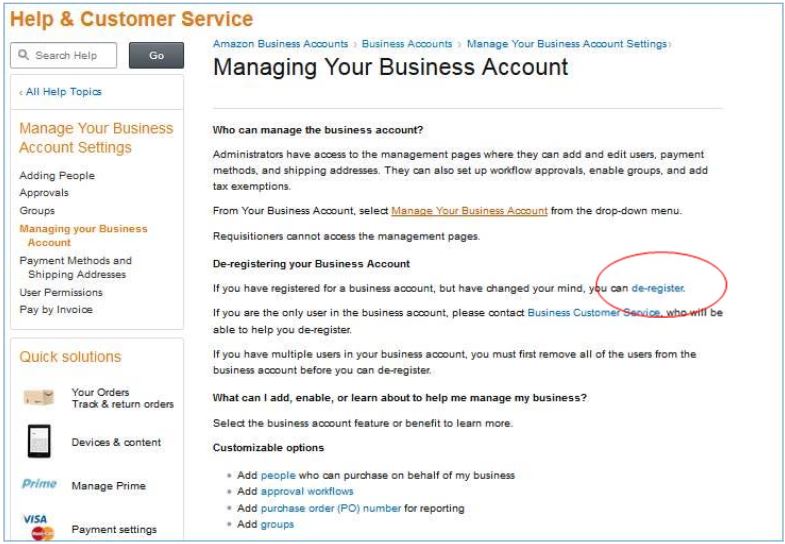

If a user has set up a business account they will need to de‐register that account before the can be invited to the main account. If they are the only person on the business account they can do this through the website. However, if they have invited other users to their account Amazon Customer Support will have to help them. Here is the link to the process. http://www.amazon.com/gp/help/customer/display.html/ref=b2b_q_3340?ie=UT... the user selects ‘de‐register’ the system will detect if they are a single user account or multi user account and direct them down the appropriate path.

Please contact AmazonBusiness@uw.edu once you have successfully de‐registered your existing Business account so we can invite you under the UW Master Account.

Screen shot of where to select de‐register:

First, there is no more reason to sign up for a personal Prime account since one of the benefits of the UW Amazon Business Prime is the same two-day shipping benefits as the personal Prime Account. Amazon Prime was designed to be a personal shopping solution and is not appropriate for conducting UW business.

If you have recently purchased a Prime membership for the sole purpose of your departmental purchases (not personal) and have barely started using the free two-day shipping benefit, Amazon will provide a prorated refund based on the estimated amount of shipping benefits already used with that Prime account.

If you are near the expiration of your Prime membership, we recommend that you let the Prime membership expire and instead of renewing and set up an Amazon Business account.

Anyone who is seeking a refund for Prime will need to contact Amazon Business Customer Support. Refunds will be based on how much of the Prime shipping benefits that have been used to date.

Amazon Business Customer Support:(888) 281-3847

AP Process

No, the University cannot send checks in foreign currency.

Under RCW 84.36.050, the UW, which includes UWMC, is exempt from property tax on real or personal property owned or used by the University in this state if used for educational purposes. Therefore, we do not have or need an exemption certificate.

However, if we are leasing, there may be a different set of rules, which depends on the type of lease. Please refer to the lease agreement between the University and supplier.

*Note: Harborview Medical Center (HMC) is not considered a UW entity for these purposes.

Best Practices

We are currently researching this question and look forward to having a definitive answer soon.

There is not a separate different process for UW Bothell or UW Tacoma subawards. They were included in the conversion effort, but you should still check them in Workday to ensure they converted correctly.

The supplier should email the invoice to uwashington@ghxinvoicing.com rather than to Procurement. This is our permanent Workday process going forward.

All Purchase Orders are transmitted via email by Workday except catalog vendors, which are sent electronically via GHX.

A subrecipient must be both a Supplier and a Subrecipient in Workday. Follow instructions on adding a new Supplier. The subrecipient must also be designated as a subrecipient in Workday. If your subrecipient is not designated as a subrecipient in Workday, send an Award Portal request to Grant & Accounting (GCA) to request designatioin of anew subrecipient. Note: Entity must already be a Supplier in Workday. If the subrecipient is not in SAGE, have your subrecipient complete the New Subrecipient Entity Certification Form then, send that form to OSPsubs@uw.edu

Contact the contract manager to correct the PO in order to avoid duplicate orders.

As part of the data conversion at go-live, Workday Supplier Contract & PO were created for open, active subaward BPOs in Ariba. The Workday PO number is the same as the Ariba BPO number. Please note, there are some Supplier Contracts and/or POs that could not be automatically created. Procurement and OSP are working on a process to address these situations and will communicate details as soon as possible. Please do not create a PO in Workday. Subaward POs have their own business process.

You may order directly from Digi-Key on a purchase order using a quote.

You can type the supplier's invoice number in the Workday Search field and the SI Invoice number will come up if the invoice has been submitted. The purchase order will also show as partially invoiced, and you can see the invoice number on the line-item detail.