Contact Accounts Payable (checks) at checks@uw.edu and provide the check # of the check you wish to cancel. The check # can be obtained by checking my FD.

To reissue the payment, a new ER will need to be processed after confirming the live check has been cancelled.

Please make a comment on the old ER stating the check number and confirmation that it has been cancelled. After confirming cancellation, on the new ER, please make a comment stating that it is replacing the previous ER.

To speed up the process, you can use the ‘copy’ function in Ariba. Note that all attachments will need to be reattached and all comments will need to be re-added. Here are the instructions:

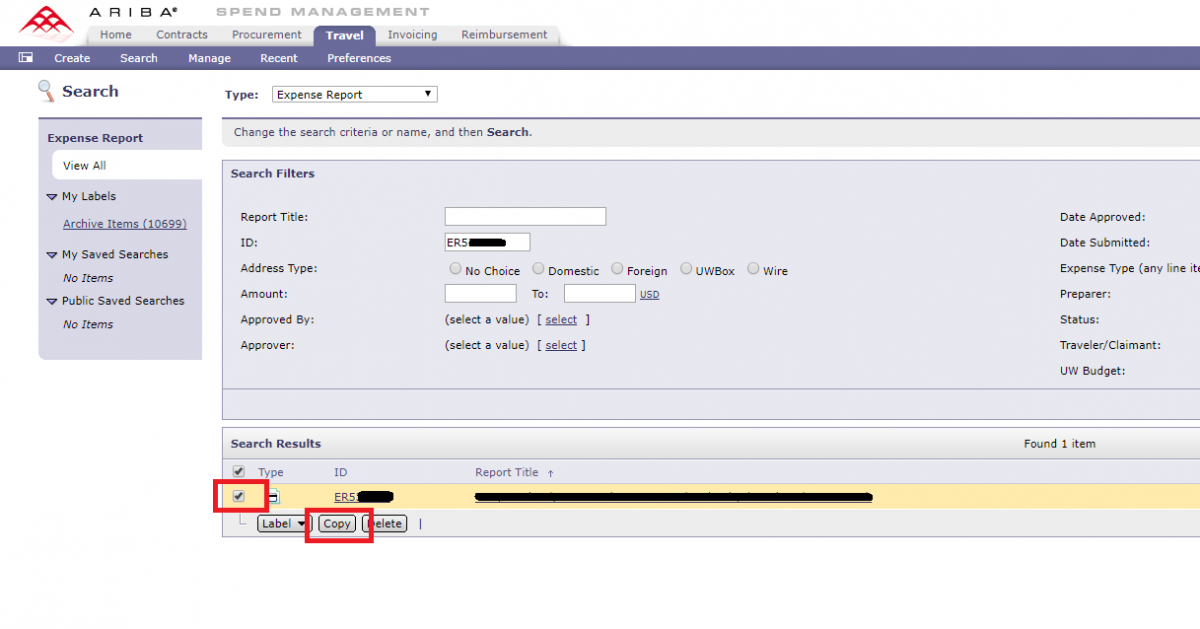

1. Locate the previous Expense Report by searching for it

2. Select the Expense Report by marking the check-box to the left of it (do not actually open the report)

3. Click on the 'copy' button, which will be right below

4. Click the travel tab at the top of Ariba, the copy report will be in the 'My Documents' section of your dashboard

5. Please attach all of the required receipts/documents, as they won’t be automatically copied

6. Please re-create line item comments and overall comments, as they won’t be duplicated either

Here is a screenshot example:

*Signature from previous report may be attached as long as the expense line items/amount has not been changed.