The Budget Summary includes budgeted amounts, encumbrances, transaction totals, and budget balances and is the online equivalent to the printed BSR. The Budget Summary Report now also includes Open Balances. Open Balances are outstanding commitments on a budget for orders or contracts placed through the Ariba system (eProcurement).

This report is not limited by access; anyone with access to MyFD may look at the Budget Summary Report for any budget.

To view the Budget Summary Report:

- Select Budget Summary from the Reports dropdown menu

- Enter a budget number in the View Budget # field, select a time period, and click Go

Reading the Budget Summary Report

Read the Budget Summary from left to right, starting with the Account Code Column. Expenditures are categorized by account codes. If there was activity in an account code during the reporting period, the account code and description will be blue links; click on these to see more detail in the Transaction Summary report.

The Budgeted Amount column shows the amount originally budgeted by account code. For some budgets and account codes, there may be no budgeted amount and this is expected.

To the right of the Budgeted Amount is the Total Prior Transactions; this is the total amount spent, by account code, between the budget period start date and the beginning of the reporting period displayed. The reporting period Transactions indicates the amount spent during the reporting period displayed.

Encumbrances & Open Balances displays the amount that has been encumbered as well as open balance commitments for orders or contracts placed through the Ariba system (eProcurement). Encumbrances may be included or excluded in the remaining amount by clicking on the "Include Encumbrances" checkbox. Open Balances also has the ability to be included or excluded in the remaining amount by clicking on a new "Include Open Balances" checkbox.

The Total Transactions is the sum of the total prior transactions and reporting period transactions.

*A note about Reporting Period: MyFD automatically displays the correct Project Reporting Period for each specific budget type and by extension, the correct Remaining Budgeted Amount. For grant budgets the "Activity to Date" option is available; for state budgets, the "Fiscal Year" and "Biennium" options are available. Most state budgets do not use the Project Reporting Period accounting flag, so making a different selection (like Activity to Date) on a state budget would actually work against displaying the correct Remaining Budgeted Amount.

How do I find my budget balance?

Budget balances are located on the Budget Summary, but are found in slightly different places for state or grant budgets than for revenue-generating budgets.

Determine if your budget is a state, grant or a revenue generating budget while looking at the Budget Summary:

- If there is a single green line at the bottom of the report that says "Total Expenditures" or a green line and an additional gray "Total Revenue" line, read this like a state or grant budget

- If there is a "Total Expenditures" line, gray "Total Revenue" line AND a green "Cumulative Net (Income) or Loss" line, this is a revenue-generating budget

State or Grant Budgets:

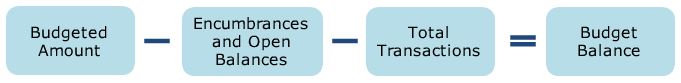

Balances for State/Grant budgets are calculated using figures in the green Total Expenditures line according to this formula:

Click here to view a rollover demonstration of how to find the budget balance for a state or grant budget.

Self-Sustaining (Revenue-Generating) Budgets:

Generally speaking, the balance on a self-sustaining budget is the difference between the total expenditures and total revenue. However, it is essential that you understand how your department manages and maintains these budgets. There are different ways of managing these types of budgets that may affect how this report can be read and consequently, where the budget balance is located. Some departments use the budgeted amount column while others do not. Use of this column will affect how the budget balance is seen on the report.

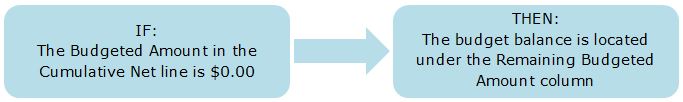

If there is NO budgeted amount in the Cumulative Net line, the budget balance is located in the Cumulative Net (Income) or Loss Line under the Remaining Budgeted Amount column. Tip: Parenthesis indicate a loss and no parenthesis represent income.

Click here to view a rollover demonstration of how to find the budget balance for a self-sustaining budget.

If the "Cumulative Net Income Loss" line is NOT zero, MyFD report calculations may not accurately report the budget’s balance. For these few budgets, the necessary course of action for identifying the budget balance is to speak with your budget administrator (or person in charge of budget revisions for your unit) about how these funds are used and managed within your department.

IMPORTANT NOTE: If your department does not need to use the budgeted amount column for self-sustaining budgets, and there are amounts displayed in that column, you may contact the Office of Planning and Budgeting so they may assist you in making the necessary changes in the budget system (BGT). Unfortunately, the MyFD Team cannot assist with BGT modifications.

Need more information?

Check out the Introduction to the Budget Summary eLearning or our FAQs on Reports / Budget Summary.